PCI DSS compliance refers to adherence to the Payment Card Industry Data Security Standard (PCI DSS), a globally recognized set of security requirements created to safeguard cardholder data during storage, processing, and transmission. Developed by the PCI Security Standards Council (PCI SSC), this framework mandates specific security controls for any entity that accepts, processes, or stores credit card data. PCI DSS applies to merchants, financial institutions, service providers, and cloud platforms that host payment applications.

In modern IT environments, achieving PCI DSS compliance is no longer limited to on-premises infrastructure. Organizations increasingly operate in hybrid and multi-cloud environments, where payment data flows across distributed systems, containers, and serverless platforms. PCI DSS compliance has evolved to address these complexities while maintaining its core objective: protecting sensitive cardholder data against theft and fraud.

Why is it important?

Payment card fraud represents a significant global threat, costing billions of dollars annually. PCI DSS compliance plays a critical role in preventing breaches and securing consumer trust. Organizations that fail to comply with the standard face:

- Fines and penalties: Non-compliance can lead to penalties of up to $100,000 per month, increased transaction fees, or termination of payment processing privileges.

- Reputational damage: A cardholder data breach can severely undermine customer confidence.

- Legal liability: Inadequate security controls may expose businesses to lawsuits, especially under data privacy regulations.

Beyond risk mitigation, PCI DSS compliance helps organizations:

- Establish security baselines: Provides a structured approach to securing payment systems.

- Demonstrate due diligence: Signals commitment to data protection and customer privacy.

- Meet industry expectations: Compliance is often a requirement for doing business with partners and service providers.

In cloud-first environments, PCI DSS remains essential. While cloud providers manage the infrastructure, customers are responsible for securing their configurations, access controls, and payment application deployments. This shared responsibility model makes compliance a joint effort.

How does it work?

The PCI DSS framework consists of 12 core requirements, organized under six primary objectives:

- Build and maintain a secure network and systems

- Protect cardholder data

- Maintain a vulnerability management program

- Implement strong access control measures

- Monitor and test networks regularly

- Maintain an information security policy

Compliance requirements vary based on merchant level, which is determined by annual transaction volume:

- Level 1: Over 6 million transactions annually, requires on-site assessments.

- Level 2-4: Lower volumes, may qualify for self-assessment questionnaires.

In cloud environments, compliance requires:

- Mapping data flows: Understanding how cardholder data moves through cloud applications and services.

- Segmentation: Isolating cardholder data environments from other workloads.

- Encryption: Encrypting data in transit and at rest using strong algorithms.

- Access control: Implementing role-based access, MFA, and strict least-privilege policies.

- Logging and monitoring: Tracking user activity and access to payment data.

Many cloud service providers offer PCI DSS-compliant services, but customers must validate proper implementation of controls within their environments.

Security risks and challenges

Achieving PCI DSS compliance in cloud environments introduces unique challenges:

- Misconfigurations: Improperly configured cloud storage (e.g., open S3 buckets) can expose payment data.

- Complex environments: Multi-cloud and hybrid deployments complicate visibility and control.

- Legacy applications: Older systems may lack required controls like logging, encryption, or secure authentication.

- Unsecured APIs: APIs handling payment data must be protected against abuse and injection attacks.

- Container and serverless challenges: Ephemeral infrastructure requires new approaches to monitoring and control.

The shared responsibility model can also lead to confusion about which party is accountable for specific controls, increasing the risk of gaps in compliance.

Best practices and mitigation strategies

To ensure PCI DSS compliance in the cloud, organizations should:

- Segment networks: Isolate cardholder data environments to reduce scope and limit exposure.

- Use tokenization and encryption: Minimize storage of cardholder data by using secure tokenization services and strong encryption.

- Apply least-privilege access: Limit access to cardholder data using role-based policies and enforce multi-factor authentication.

- Implement continuous monitoring: Use centralized logging and alerting tools to detect unauthorized access and anomalous behavior.

- Conduct regular vulnerability scans: Perform quarterly internal and external scans, and follow up with remediation.

- Automate security controls: Use infrastructure-as-code and automation tools to enforce consistent configurations.

- Perform regular audits: Validate the effectiveness of controls and readiness for formal PCI DSS assessments.

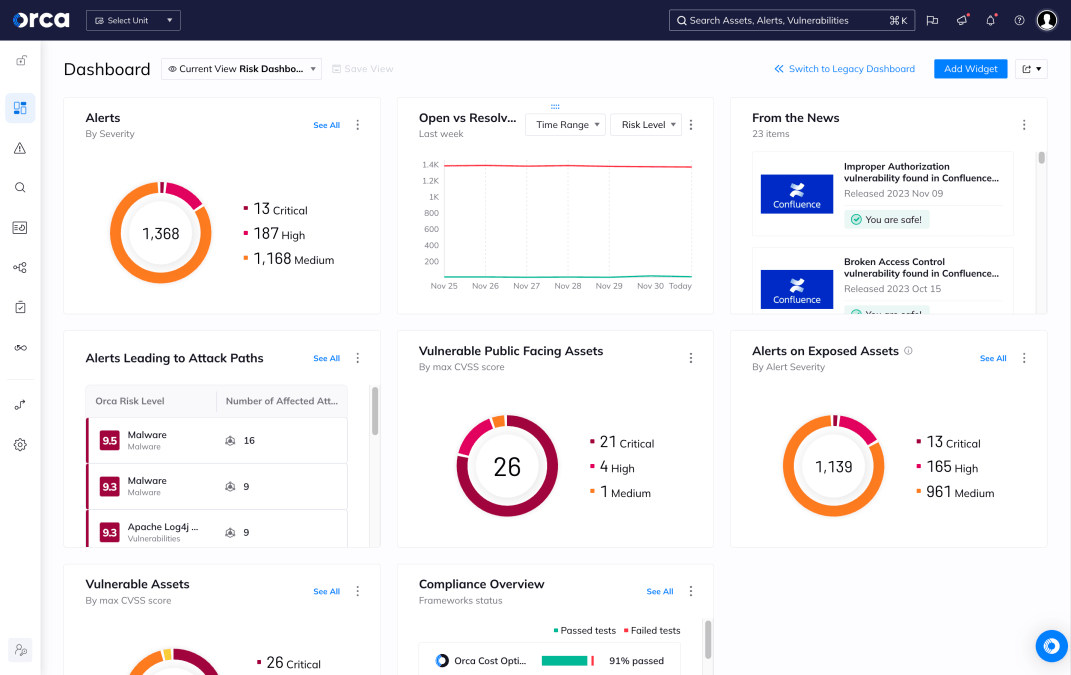

How Orca Security helps

The Orca Cloud Security Platform simplifies PCI DSS compliance across the multi-cloud environments of AWS, Azure, Google Cloud, Oracle Cloud, Alibaba Cloud, and Kubernetes. Key capabilities include:

- Full cloud coverage: Automatically discovers, inventories, and continuously monitors all cloud resources across your cloud estate.

- Compliance mapping: Detects and prioritizes compliance issues and automatically maps them to more than 185 built-in regulatory and industry-specific compliance frameworks

- Automated tracking and reporting: Continuously tracks compliance over time and updates statuses automatically, as well as supporting automatic or ad hoc reporting

- Two-way integrations: Offers automated notifications and workflows for compliance issues that work across ticketing and development systems as well as security tools

Orca enables security teams to enforce PCI DSS controls across complex cloud environments without requiring agents or slowing down operations.