The Digital Operational Resilience Act (DORA) is a European Union regulation designed to ensure the financial sector can withstand and recover from ICT-related disruptions. Officially effective as of January 17, 2025, DORA introduces a harmonized regulatory framework across EU member states for managing information and communication technology (ICT) risks in financial institutions. It goes beyond traditional cybersecurity regulations by mandating operational continuity, incident response, third-party risk management, and digital resilience testing. Financial entities—including banks, insurance companies, investment firms, and crypto-asset service providers—must comply with DORA’s provisions to maintain secure and stable financial services.

What is the Digital Operational Resilience Act (DORA)?

DORA establishes a comprehensive set of requirements for how financial entities must manage digital risks. Its five core pillars include ICT risk management, incident reporting, resilience testing, third-party risk oversight, and information-sharing mechanisms. This regulation mandates that financial institutions establish end-to-end visibility into their digital operations, continuously monitor for risks, test their preparedness for cyber events, and maintain detailed response and recovery plans.

Importantly, DORA applies not only to traditional financial firms but also to ICT service providers that are deemed critical to financial stability—such as cloud providers, data analytics firms, and software vendors. These third parties are subject to direct oversight under DORA when deemed systemic, reflecting growing regulatory concern about cloud concentration risk in the financial sector.

Why DORA is important

As digital transformation accelerates, financial institutions increasingly depend on cloud infrastructure, SaaS applications, and technology partners to deliver services. This interconnected digital ecosystem increases the risk that cyberattacks, software failures, or third-party outages could trigger widespread financial instability. DORA aims to mitigate these risks through regulatory alignment and standardized resilience practices across the EU.

According to ENISA, the financial sector is a prime target of cyberattacks. DORA addresses this exposure by requiring continuous risk management, mandatory testing, and visibility into third-party dependencies. It also responds to recent events like SolarWinds and Kaseya breaches, which highlighted the impact of supply chain vulnerabilities on critical services.

By unifying the ICT risk frameworks that were previously spread across multiple EU directives (e.g., NIS Directive, EBA Guidelines), DORA simplifies compliance for cross-border institutions and strengthens overall resilience in the financial system.

How DORA works

DORA is structured around five interdependent pillars:

- ICT risk management: Financial entities must implement governance structures, risk assessment methodologies, security policies, monitoring controls, and business continuity plans. This includes maintaining a complete inventory of ICT assets and their interdependencies.

- Incident reporting: Major ICT-related incidents must be classified and reported to relevant authorities within strict timeframes. Institutions must define severity thresholds, collect forensic data, and coordinate reporting workflows.

- Digital operational resilience testing: Entities must regularly test their systems’ ability to withstand cyber threats. For significant institutions, this includes advanced techniques like threat-led penetration testing (TLPT).

- Third-party risk management: Financial firms must perform due diligence on ICT service providers, continuously monitor performance, and maintain exit strategies. Critical providers may face direct regulatory oversight.

- Information sharing: Voluntary sharing of cyber threat intelligence, indicators of compromise (IOCs), and best practices is encouraged through trusted platforms and sectoral hubs.

Together, these requirements ensure that digital resilience is proactively maintained—not just during incidents, but continuously throughout the technology lifecycle.

Security risks and challenges

While DORA strengthens the financial system’s defenses, implementation presents several challenges:

- Visibility gaps: Cloud and hybrid environments often lack centralized visibility, making it difficult to inventory assets or assess their resilience.

- Third-party sprawl: Financial institutions rely on a growing number of third-party vendors, including sub-processors. Evaluating and monitoring each vendor’s security posture at scale is complex.

- Cloud concentration risk: The sector’s dependence on a small group of hyperscale cloud providers introduces systemic vulnerabilities. A service disruption or compromise could affect multiple institutions simultaneously.

- Regulatory overhead: DORA adds new compliance requirements that may overlap with existing frameworks (e.g., GDPR, NIS2, EBA). Financial institutions must streamline reporting and avoid redundancy.

- Operational impact: Advanced resilience testing (e.g., TLPT) can inadvertently expose systems or introduce risks if not scoped carefully.

Best practices and mitigation strategies

To prepare for and comply with DORA, organizations should adopt the following best practices:

- Implement cloud-native visibility: Use tools that provide agentless-first coverage and monitoring of multi-cloud environments to maintain a complete ICT asset inventory.

- Automate incident detection and response: Deploy systems that classify incidents, trigger automated responses, and support forensic analysis. Integrate alerts with SIEM and SOAR tools.

- Assess third-party risk continuously: Maintain a risk-tiered registry of vendors, perform security reviews before onboarding, and implement SLAs with incident notification clauses.

- Test operational resilience regularly: Schedule tabletop exercises, backup recovery simulations, and red teaming to validate system readiness. For critical entities, conduct TLPT in line with threat intelligence.

- Establish board-level governance: Ensure executive stakeholders are engaged in DORA planning and that risk tolerances are formally documented and reviewed.

How Orca Security helps

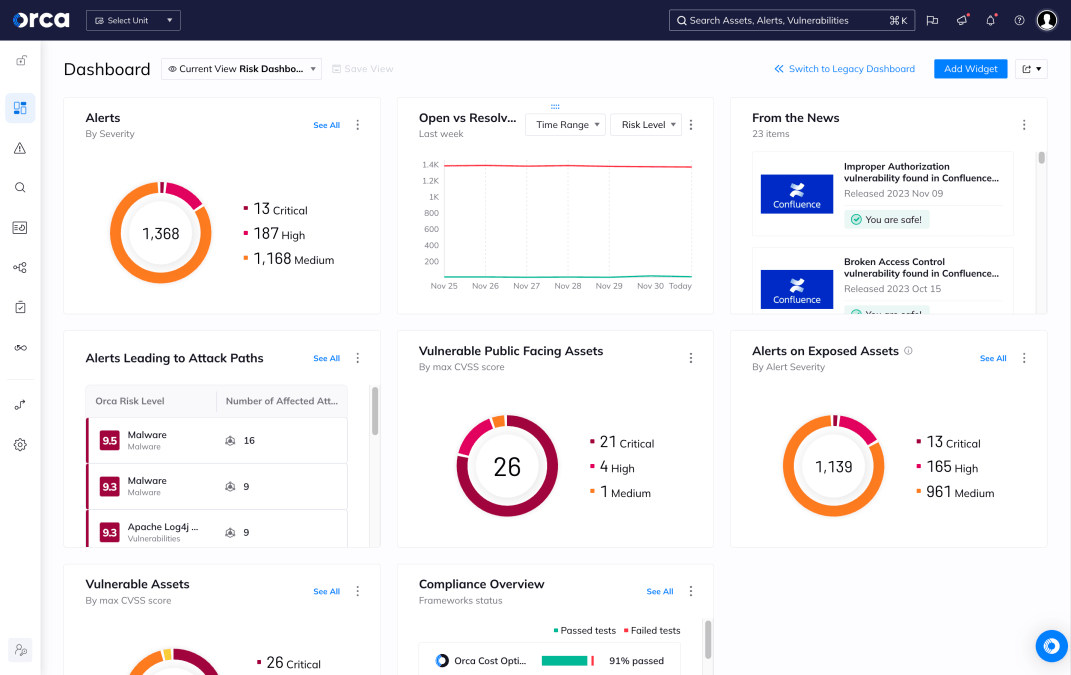

The Orca Cloud Security Platform automates and simplifies DORA compliance across the multi-cloud environments of AWS, Azure, GCP, Oracle Cloud, Alibaba Cloud, and Kubernetes. Combining full coverage and comprehensive risk detection, Orca enables teams to:

- Automatically and continuously track compliance against a library of 185+ built-in regulatory and industry frameworks, including DORA

- Automate reporting using flexible options for exporting, scheduling, and sending reports in multiple formats and channels

- Leverage automations to streamline compliance workflows and tasks

- Take advantage of two-way integrations to accelerate the resolution of compliance issues across different functional teams

Orca empowers DORA-regulated organizations to continuously manage digital risk and ensure service resilience in line with evolving regulatory expectations.