Table of contents

- What is fintech cloud security?

- Why cloud security is critical for fintech

- The role of cloud services in fintech operations

- Key components of fintech cloud security

- Common cloud security risks and threats in fintech

- Best practices for enhancing fintech cloud security

- The future of fintech cloud security

- How to achieve fintech cloud security with Orca

- Conclusion

- FAQs

For organizations in financial technology (FinTech), cloud security constitutes a top priority and perceived risk, according to a study by McKinsey and the Institute of International Finance (IIF).

Today, FinTech firms depend on cloud computing to power everything from mobile banking to investment platforms. Yet as security risks increase and regulations tighten, they need advanced technology that can secure their cloud innovations. That’s the purpose of FinTech cloud security, providing comprehensive protection across the cloud-native infrastructure and workloads they depend on.

In this article, we dive deep into the field of FinTech cloud security, revealing what it means, why it matters, how it works, and how your organization can use it to protect your innovation.

What is fintech cloud security?

Fintech cloud security is a set of measures and policy practices that safeguards financial data and transactions in the cloud. It acts as a secure vault, defending digital assets from cyber threats while utilizing cloud technology. As financial technology becomes more dependent on cloud computing, effective security is essential.

Strong cloud security prevents data breaches and ensures compliance with strict regulations. It also builds customer trust, reassuring clients that their assets are safe.

Fintech companies face a multitude of risks, including vulnerabilities, misconfigurations, sophisticated malware, and much more. Each can result in significant security incidents and compliance issues that organizations must contend with. Fortunately, advancements in cloud security technology enable fintech firms to successfully navigate these challenges.

Why cloud security is critical for fintech

In the world of fintech, security represents a universal concern touching every department and employee across an organization. Grasping the essentials of cloud security is vital for safeguarding business continuity in a market that depends on cloud computing and cloud-native applications. Let’s explore the significance of cloud security for fintech companies and the unique challenges they face.

Unique security challenges in fintech

Fintech firms handle sensitive information, including personal data and significant financial assets, making them prime targets for cybercriminals. Here are two key challenges:

1. Compliance requirements

Fintech companies operate within a tightly regulated framework, facing requirements such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI-DSS). These regulations mandate stringent data protection practices, and non-compliance can lead to severe penalties. For example, GDPR fines alone can reach up to €20 million or 4% of a company’s global revenue. Organizations must sustain robust cloud security controls to maintain compliance and avoid catastrophic financial consequences.

2. Sensitive data

The fintech sector depends on the processing of sensitive data, making it an attractive target for attackers. Fintech firms must stay on high alert and defend against compromises, as they can result in costly data breaches. According to IBM’s Cost of a Data Breach Report, data breaches cost finance firms $6.08 million (USD) on average globally, with 40% of these breaches involving data stored in multiple cloud environments. This average cost represented the second highest total across all industries, highlighting the urgent need for effective cloud security measures to protect valuable data.

The role of cloud services in fintech operations

The double-edged sword of cloud services

Cloud services revolutionize fintech operations by providing flexibility and cost-efficiency. They enable rapid scaling to meet fluctuating market demands, which is crucial in a fast-paced industry. However, this convenience comes with heightened cybersecurity risks, such as data breaches and denial-of-service (DoS) attacks. Fintech companies must navigate the delicate balance between leveraging cost-effective solutions and implementing robust security measures.

Great power, great responsibility

While cloud services can enhance security, they also introduce new vulnerabilities. Misconfigurations, shared responsibility models, and the complexity of cloud environments can expose organizations to risks if not managed carefully.

Impact of security breaches on fintech companies

A security breach can present devastating consequences for fintech firms, including the following:

- Financial losses: Security incidents can lead to significant financial setbacks for fintech firms, from direct theft to regulatory penalties and more. The average cost of a data breach globally reached $4.88 million (USD). For fintech firms, this figure stands at more than $6 million (USD), the second most of any industry, trailing only healthcare.

- Operational disruptions: Security breaches often result in system downtime and disruptions to business operations, resulting in significant financial losses, lost business opportunities, customer churn, and more. For most organizations, it takes more than 100 days to fully recover after a data breach, according to IBM’s study.

- Legal repercussions: Breaches can trigger lawsuits and hefty fines due to regulatory violations. Maintaining robust cloud security is crucial for avoiding these costly legal entanglements.

- Reputational damage: In sensitive industries such as fintech, preserving trust remains paramount to organizational success. High-profile data breaches and lengthy business disruptions put stakeholder trust in jeopardy, risking customer attrition, lost business, and reputational challenges both in the short- and long-term.

In this high-stakes environment, robust cloud security is not just about protecting data—it’s about safeguarding your entire business. By implementing comprehensive security measures and remaining vigilant, you can harness the power of the cloud while keeping your assets and reputation intact.

Key components of fintech cloud security

Fintech cloud security depends on a collection of measures that help protect sensitive data, cloud resources, and digital services from exploitation. By prioritizing these key components, you can help preserve your business continuity, innovation, and ability to compete in the market.

Security posture management

According to Gartner, 60% of organizations will make cloud misconfigurations a top priority by 2026. Organizations must ensure the proper configuration of their cloud infrastructure to avoid significant security risks, including exposed secrets, overprivileged identities, vulnerabilities, neglected cloud assets, and more. This calls for implementing and sustaining the following measures:

- Enforcing security policies that prevent misconfigurations.

- Auditing existing configurations to identify risks.

- Performing compliance checks of cloud infrastructure.

- Ingesting data from threat tools of cloud providers.

- Centralizing cloud configuration management, including across multiple clouds.

For security posture management, organizations rely on Cloud Security Posture Management (CSPM) solutions, typically offered through a more comprehensive Cloud-Native Application Protection Platform (CNAPP).

Workload protection

In cloud computing, a cloud workload acts as the engine that powers cloud applications or services. It can include resources (e.g., virtual machines, storage, networking) and the applications that depend on them. Unfortunately, workloads face several security risks, including vulnerabilities, misconfigurations, malware, and more. To facilitate cloud workload protection, organizations must adopt the following measures:

- Performing a complete inventory of cloud workloads.

- Continuously monitoring, detecting, and remediating risks and threats.

- Ensuring cloud workloads meet compliance requirements.

- Centralizing the protection of cloud workloads in a unified console or dashboard.

To protect cloud workloads, organizations utilize CNAPPs that provide Cloud Workload Protection Platform (CWPP) capabilities.

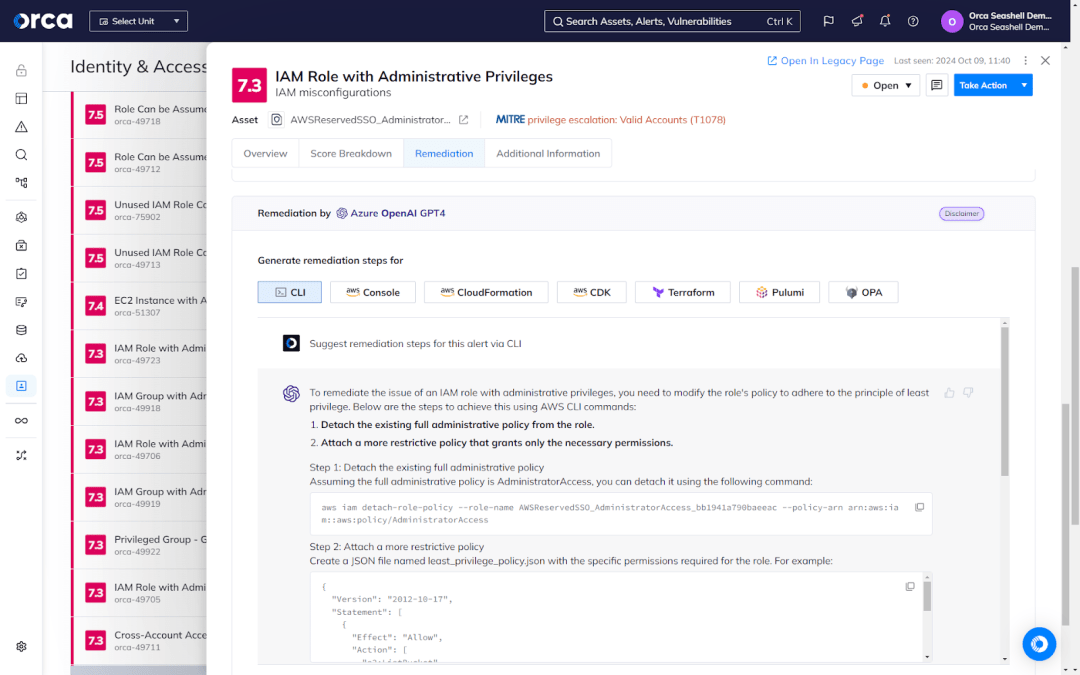

Identity and Access Management (IAM)

Identity and Access Management (IAM) represents a core security requirement, ensuring that only the appropriate identities can access the right resources at the right time. Unauthorized access, over-permissioned identities, lateral movement, and other IAM risks can result in significant consequences for fintech firms. That’s why organizations must implement the following IAM measures:

- Continuous monitoring for all identities, roles, groups, permissions, and policies across cloud estate.

- Detecting and remediating IAM risks, including such as exposed keys that can facilitate lateral movement.

- Ensuring the adoption of Principle of Least Privilege (PoLP) policies.

- Managing compliance in relation to cloud identities and entitlements.

- Centralizing IAM data, risks, and capabilities in a dashboard.

For IAM, organizations rely on Cloud Infrastructure Entitlement Management (CIEM) technology, most often as part of a unified CNAPP.

Data security

According to the Orca 2024 State of Cloud Security Report, 21% of organizations have at least one public-facing storage bucket containing sensitive data. That’s concerning, considering that this puts them at risk of data exfiltration, ransomware, reputational damage, and regulatory penalties. Organizations not only need to ensure that data stores containing sensitive data are never publicly accessible, they also need to implement robust data security measures, including:

- Identifying where sensitive data lives in your cloud and who can access it.

- Eliminating shadow data to minimize your attack surface.

- Ensuring proper configurations to implement cloud provider security controls and follow best practices.

- Ensuring strict access controls, data segregation, and continuous monitoring.

For data security in the cloud, organizations use the Data Security Posture Management (DSPM) capabilities of their CNAPP.

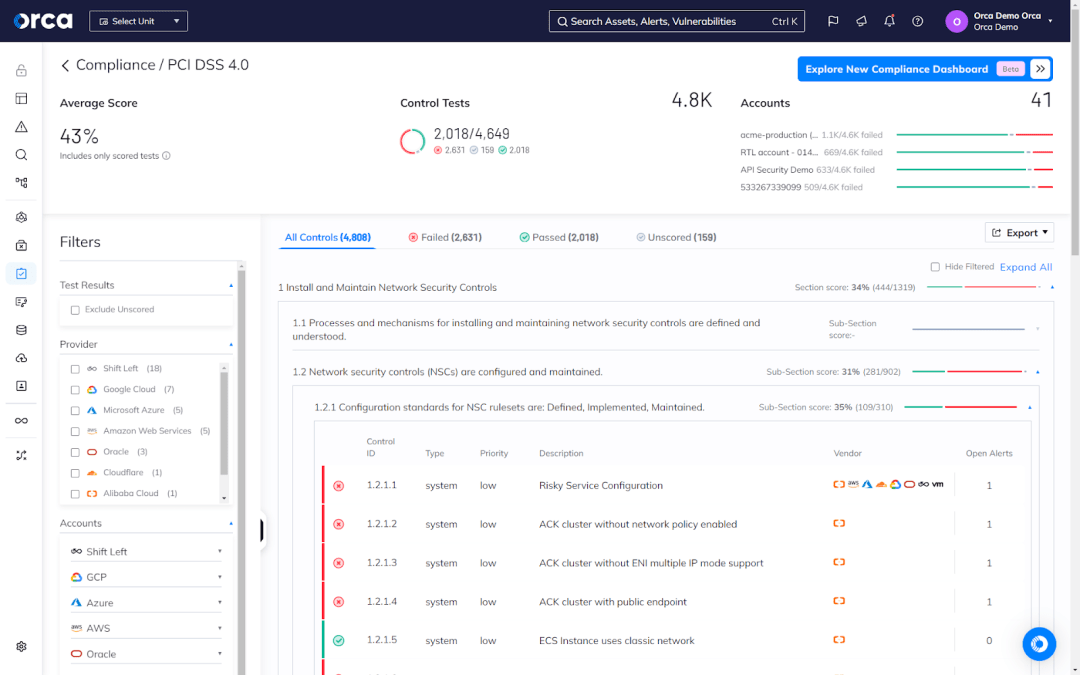

Compliance with Regulatory Standards

Organizations in financial services face stringent compliance requirements, as do other companies in essential industries. Meeting and adhering to these standards is not only important, but paramount to preserving business continuity. When it comes to cloud environments, organizations must implement the following measures to ensure compliance:

- Selecting all compliance frameworks to track against.

- Mapping cloud assets and risks to existing frameworks.

- Continuously monitoring framework controls and detecting instances of non-compliance.

- Remediating instances of non-compliance.

- Performing routine compliance checks.

- Reporting compliance status regularly to different stakeholders.

Considering the ephemeral and dynamic nature of cloud environments, compliance demands automation and the assistance of technology. Typically, organizations rely on CNAPPs that offer Multi-Cloud Compliance capabilities, as CNAPPs ensure the full coverage and complete risk detection that compliance demands.

Common cloud security risks and threats in fintech

As fintech continues to revolutionize the financial industry, it also faces unique security challenges. Let’s dive into some of the most prevalent cloud security threats impacting fintechs.

Cloud misconfigurations: a silent threat

Cloud misconfigurations are a top concern and security risk, as covered earlier in this post. That’s because cloud misconfigurations happen frequently and remain prevalent as cloud environments continually change. Consider some of the following misconfigurations found the Orca State of Cloud Security Report:

- 81% of organizations have public-facing neglected assets with open ports.

- 61% of organizations have a root user or account owner without MFA.

- 82% of organizations have an exposed Kubernetes API server.

Each of these misconfigurations increase the likelihood and impact of exploitation.

Vulnerabilities

Vulnerability exploitation remains the top cause of data breaches, according to the Verizon 2024 Data Breach Investigations Report. That’s not surprising, considering that security teams can only address approximately 10% of vulnerabilities detected each month. Vulnerabilities can exist in a variety of cloud resources, making it vital for teams to detect and prioritize the most critical ones.

Data breaches

As examined previously, data breaches represent a top threat to organizations in the financial services sector. On average, a single breach costs financial firms more than $6 million (USD) and more than 100 days to recover. But these figures only account for direct and immediate consequences. They don’t take into consideration the damage to reputation, competitive advantage, and other factors material to business growth and continuity.

Best practices for enhancing fintech cloud security

Let us look into some of the best practices that will help you fortify your fintech cloud security and stay ahead of security threats in the industry.

Acquire CNAPP technology

Fintech cloud security demands automation purposely built for cloud-native risks, applications, and environments. CNAPPs consolidate point solutions into one platform and provide full visibility into your cloud estate. Finding and adopting the right CNAPP represents the first step of a successful strategy, allowing you to gain full coverage and a complete inventory of your cloud resources and estate.

When choosing your CNAPP, look for these characteristics at a minimum:

- Ability to support multi-cloud environments across all your cloud providers.

- Fast and easy deployments.

- 100% coverage of your cloud estate, with deep and wide visibility.

- Comprehensive risk detection across all types.

- Risk prioritization, attack path detection, and fast and flexible remediation.

- End-to-end compliance support and automation.

- AI-driven security features.

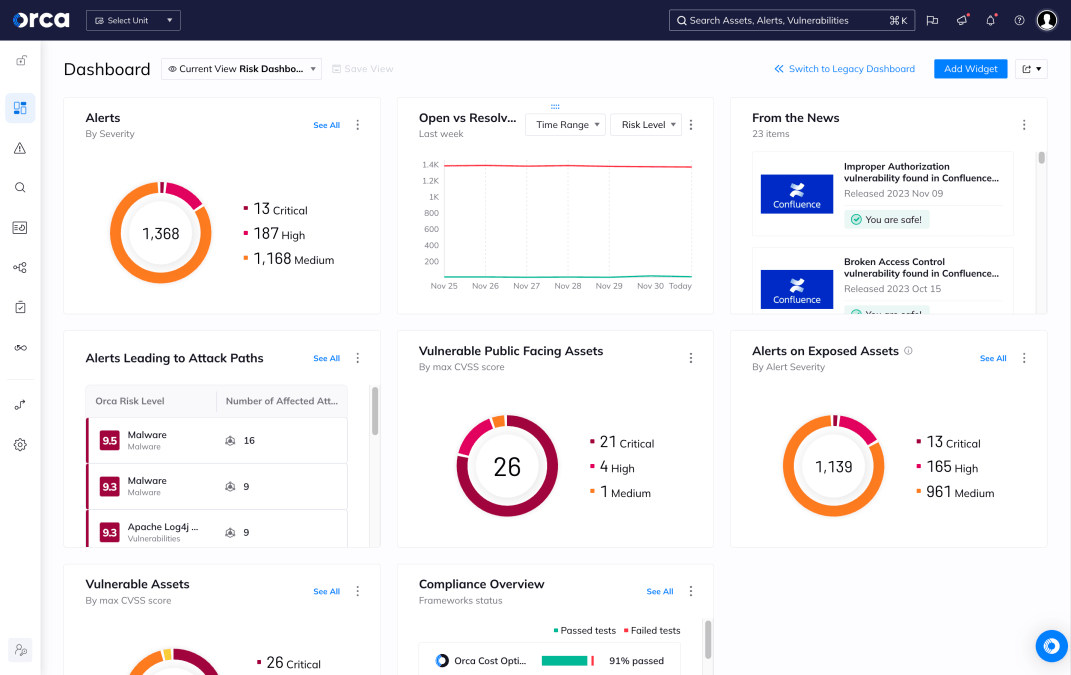

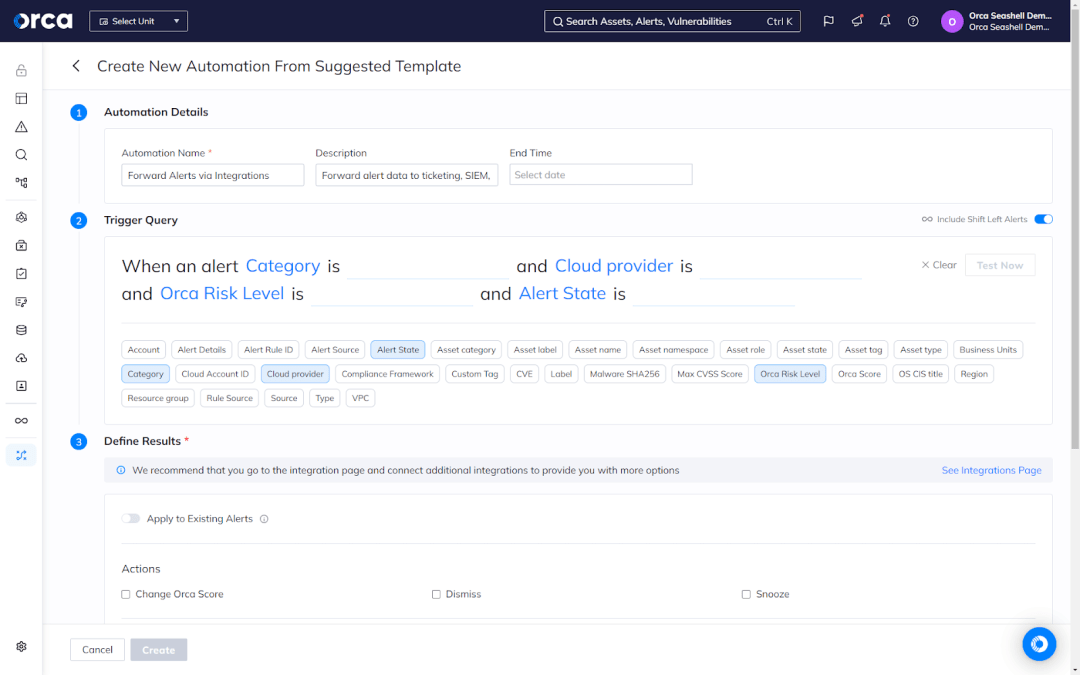

Leverage configurations and automated workflows

Most fintech cloud security solutions offer the ability to configure the technology to fit your organization’s unique needs. Examples include building dashboards tailored to specific teams or use cases, creating custom alerts for special risks, developing filters for scoping cloud data automatically, and more. These solutions also offer the ability to create automated workflows, which perform routine tasks without intervention. Together, they can help you improve security, save time, and focus on higher-value activities.

The Orca Cloud Security Platform enables you to build custom automations for a variety of use cases. You choose your conditions to trigger the automation, define the desired action, and apply the automation. For example, you can create an automation that generates a ticket in Jira when a specific alert is detected and automatically assign it to the appropriate developer. Orca’s Automations enable you to accelerate Mean Time to Resolution (MTTR), improve productivity, and increase capacity.

Automate and accelerate compliance efforts

Similar to custom configurations, advanced CNAPP solutions offer the ability to automate and accelerate your compliance initiatives. These solutions offer pre-built templates that cover the controls of common regulatory frameworks and industry standards. These templates allow you to monitor, address, track, audit, and report on areas of compliance and non-compliance and do so continuously.

The Orca Cloud Security Platform offers more than 160 out-of-the-box frameworks covering all major regulatory and industry compliance standards, as well as the ability to create custom frameworks. Orca’s Compliance Platform automatically maps cloud resources and risks to the standards of each framework, allowing you to automatically see your up-to-date compliance status, including each compliant and non-compliant control. Orca also offers the ability to generate ad hoc reports on demand or schedule recurring reports in multiple formats.

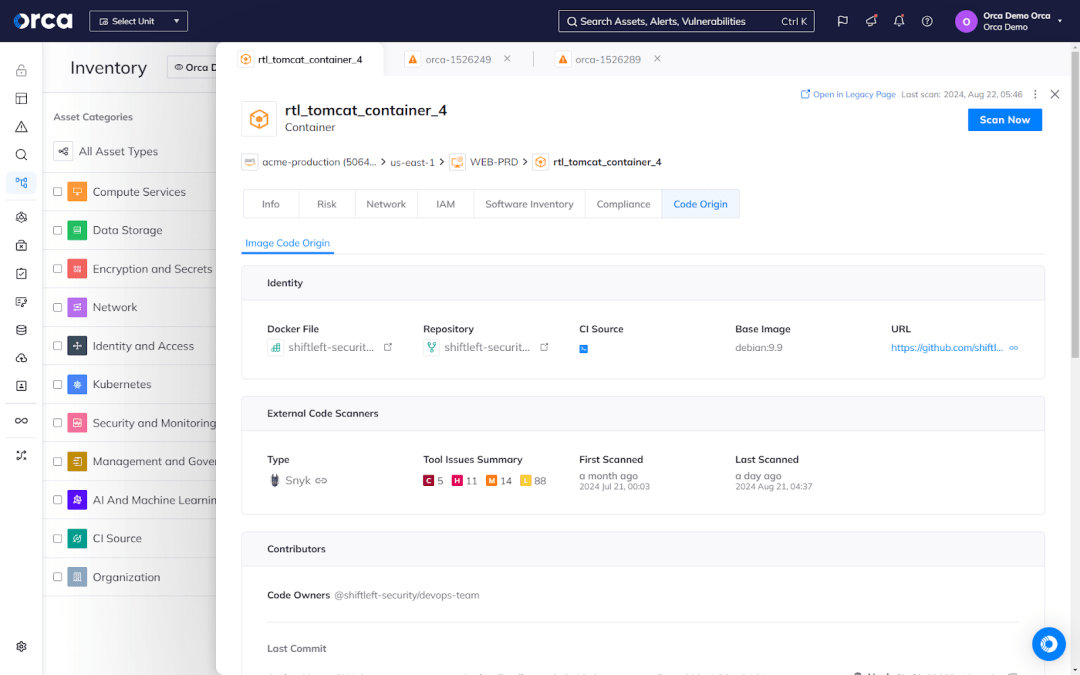

Embrace DevSecOps

For fintech organizations, DevSecOps—or incorporating security at every stage of the application lifecycle—helps maximize security while minimizing effort. Sophisticated CNAPPs offer technology that supports end-to-end DevSecOps and shifts security left in the software development lifecycle (SDLC). These solutions help prevent risks by catching them early in the SDLC, when they’re the easiest and least time-consuming to resolve for developers. They also integrate with developers’ preferred applications and workflows to make security seamless and balance it with productivity.

Orca Cloud Security Platform offers a comprehensive Shift Left Security solution that offers IaC Security, Secrets Detection, container image scanning, Software Composition Analysis (SCA), and Source Code Management Posture Management (SCM-PM). Additionally, Orca’s Cloud-to-Dev solution enables security teams to trace risks in runtime to the source of the issue in development, including the specific code owner, contributors, source code repository, and more.

Security Training and Awareness Programs

Your employees are your first line of defense. But they can also be your greatest vulnerability if not properly trained. That explains the need for security training and awareness programs that educate your team on secure practices. Educate your team on security protocols, safe browsing habits, and key threats they may encounter, such as phishing scams.

By implementing these best practices, you can fortify your fintech cloud security strategy.

The future of fintech cloud security

Like other cloud-native industries, fintech continues to see significant changes with the advent of new innovations and technology. Below are a few of the most noteworthy trends driving change in the industry.

#1 AI-powered security features

As referenced previously, security teams can only address a fraction of the vulnerabilities detected each month. Overburdened by risks, these teams lack time, capacity, and in some cases the skills and knowledge to keep up with their daily demands. Fortunately, cloud security vendors have introduced new AI-powered security features that help alleviate this pain-point for security teams. These solutions harness generative AI (GenAI) technology to automate and accelerate critical tasks, such as performing queries, remediating risks, and more. Expect to see continued advancements in this area, with more features covering a wider set of use cases to help compensate for capacity shortages.

For example, the Orca Cloud Security Platform became the first CNAPP to integrate with ChatGPT to support the remediation of cloud risks as well as support GPT-4 through the Azure OpenAI service. Orca’s AI-Driven Search feature enables users to find answers to any question regarding their cloud estate by asking a plain language question, saving them the need to learn the query language of a particular cloud provider. Orca’s AI-Driven Remediation feature enables users to generate high-quality remediation code and instructions tailored to their unique remediation process. This greatly reduces the Mean Time to Resolution (MTTR), saves time, and adds capacity.

#2 AI security threats

Like cloud security vendors, fintech firms continue to embrace AI innovations to develop new products and services and hone their competitive advantage. While important and necessary, these investments lead to key security risks that fintech firms must protect against. In cloud security, AI multiplies many of the common risks that organizations already encounter, such as misconfigurations, vulnerabilities, IAM risks, and more. At the same time, AI also introduces new risks unique to the technology, as well as expands existing attack surfaces to cover new components such as training data.

As a result, organizations must adopt AI security solutions that protect against AI risks. In fintech cloud security, this means adopting AI Security Posture Management (AI-SPM) technology, which provides full coverage and security across your cloud provider AI services, as well as your AI models, packages, and data. The Orca Cloud Security Platform offers an advanced AI-SPM solution that covers more than 50 AI models and software training packages with its full feature set and comprehensive capabilities.

#3 Navigating the compliance landscape

As the rate of innovation accelerates, so does the complexity of the compliance landscape. Expect to see important developments in this area, including:

- More stringent data protection laws globally.

- Increased focus on AI ethics and transparency.

- Stricter requirements for cloud service providers.

To stay ahead, you need to adopt a proactive approach to compliance, regularly updating your security measures to meet new standards.

How to achieve fintech cloud security with Orca

The Orca Cloud Security Platform is an agentless-first CNAPP that enables organizations to fortify their fintech cloud security. Tailor-made for financial services, the Orca Platform detects, prioritizes, and remediates every type of cloud security risk. Leveraging Orca’s patented SideScanning™ technology, the Orca Platform provides full visibility into every layer of your multi-cloud estate, performs holistic and dynamic risk analysis, and prioritizes risks and attack paths based on environmental and business context.

Interested in seeing how the Orca Platform helps fintech firms globally? Schedule a personalized 1:1 demo with one of our experts.

Conclusion

Fintech firms continue to embrace the power of cloud computing to enhance every aspect of their operations. Yet this focus on innovation calls for an equal emphasis on security. Fintech cloud security remains vital for not only securing and enhancing innovations, but ensuring that firms can protect their business continuity and most fundamental assets. This points to the significant value of fintech cloud security technology, which can help fintech firms balance innovation and security effectively, efficiently, and sustainably.

FAQs

What is cloud security for fintech?

Cloud security for fintech refers to the set of measures, controls, and policies designed to protect the cloud workloads and infrastructure of financial technology firms. Cloud security for fintech aims to protect the confidentiality, integrity, and availability of cloud computing environments and applications.

What does fintech cloud security entail?

Fintech cloud security encompasses a wide range of practices and technologies. It involves inventorying all resources and risks across a cloud estate, including multi-cloud environments. It also entails detecting risks, analyzing them using multiple factors, prioritizing them according to criticality, alerting security teams of risks, and facilitating the remediation of alerts. Fintech cloud security also involves a set of practices and capabilities for achieving compliance with regulatory frameworks and industry standards, such as PCI-DSS, SOC 2, and GDPR.

What are the challenges of fintech cloud security?

Fintech companies face a variety of challenges when it comes to cloud security. Some of the main challenges include:

- Gaining and maintaining visibility across one or more cloud environments.

- Detecting all types of risks present in a cloud estate.

- Effectively prioritizing risks to accurately represent criticality and limit alert fatigue.

- Shift security left to support DevSecOps.

- Ease and enhance cloud compliance efforts.

Table of contents

- What is fintech cloud security?

- Why cloud security is critical for fintech

- The role of cloud services in fintech operations

- Key components of fintech cloud security

- Common cloud security risks and threats in fintech

- Best practices for enhancing fintech cloud security

- The future of fintech cloud security

- How to achieve fintech cloud security with Orca

- Conclusion

- FAQs